A federal court will not stop the Trump administration’s controversial plan to share highly sensitive taxpayer information with federal immigration officials to track down unauthorized immigrants and deport them promptly.

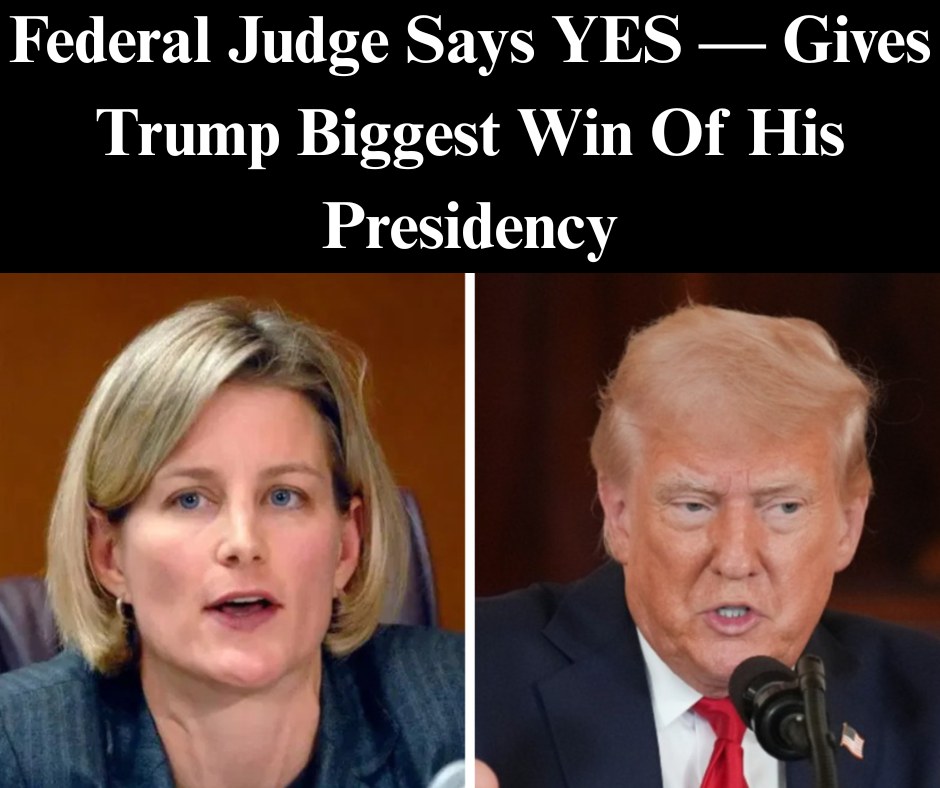

District Judge Dabney Friedrich dismissed allegations from multiple immigrant-rights groups that the data-sharing deal between the Internal Revenue Service and Immigration and Customs Enforcement breached taxpayer confidentiality rules, CNN noted.

The judgment represents a triumph for President Donald Trump’s immigration policies. Trump administration officials said that increased collaboration between the IRS and ICE will safeguard Americans by removing potentially dangerous individuals who entered the country illegally.

Trump appointed Friedrich in 2017, during his first term. The immigrant-rights groups who brought the complaint can now appeal her decision to the DC Circuit Court of Appeals.

The data-sharing agreement permits the Department of Homeland Security, which controls ICE, to request that the IRS validate the home locations of suspected illegal immigrants who are resisting deportation orders. The agreement was pushed through in early April against the protests of numerous top career IRS officials, who refused to sign it due to legal issues.

These worries originated from the fact that federal rules rigorously limit the IRS’s ability to share taxpayer information with other entities. The IRS can disclose data to help criminal investigations, but it cannot release data only to support deportations, which are considered civil matters.

The judge determined in her Monday order that the Trump administration carefully constructed the data-sharing agreement so that it seemed to conform with the law. The Justice Department has said that demands for private data will only target persons under criminal prosecution for illegally disobeying deportation orders. Immigrant organizations claim that this is a thinly veiled justification for circumventing the law.

“Requesting and receiving information for civil enforcement purposes would constitute a cognizable injury, but none of the organizations have established that such an injury is imminent,” Friedrich wrote, adding. “The Memorandum only allows sharing information for criminal investigations … On this limited record, the Court cannot assume that DHS intends to use the shared information to facilitate civil rather than criminal proceedings.”

Alan Morrison, an attorney representing the groups that sued the Trump administration, expressed disappointment with the verdict but is exploring an appeal and future action.

The judge “made it clear that DHS and IRS must comply strictly with the limited exception on which they relied,” Morrison said in a statement. “So far, DHS has not made formal requests for taxpayer data, and plaintiffs will be keeping a close watch to be sure that the defendants carry out their promises to follow the law and not use the exception for unlawful purposes.”

For decades, illegal immigrants have been urged to register with the IRS and pay their federal taxes, with assurances that their private identifying information will be kept secret.

The Trump administration’s move to abolish this barrier has caused concern in immigrant communities, prompting some unauthorized migrants to refrain from submitting federal taxes this year.

According to CNN, Elon Musk’s Department of Government Efficiency is developing a master database to simplify immigration enforcement using data from the IRS, the Social Security Administration, and other agencies.

A representative for the Treasury Department, which controls the IRS, said late last month that taxpayer information is not “being inappropriately shared across government agencies.”

Friedrich studied the data-sharing agreement at a court hearing last month, questioning whether the Trump administration created a pretext to make the arrangement legitimate. She also questioned the immigrant-rights groups that filed the lawsuit, asking them to provide evidence that the Trump administration meant to violate taxpayer privacy rules.

“At its core, this case presents a narrow legal issue: Does the Memorandum of Understanding between the IRS and DHS violate the Internal Revenue Code? It does not,” Friedrich wrote Monday in her ruling.

“The plain language of (the federal tax code) mandates disclosure under the specific circumstances and preconditions outlined in the (IRS-ICE agreement),” Friedrich added.